Acquisition Project by "Priyal Jethva"

About The Whole Truth Foods:

The Whole Truth Foods is a clean-label food brand from India, started in 2019 by Shashank Mehta, who wanted to fix the way we eat packaged food.

After his own health journey, he built the brand to offer honest, healthy snacks made only with real, natural ingredients i.e. no hidden sugars or artificial stuff.

Their popular products include protein bars, dark chocolates, and muesli. They’re big on being transparent, educating consumers, and recently raised $15 million to grow even bigger across India.

The Whole Truth Foods Elevator Pitch:

"You shouldn’t need a science degree to read your food label. We make genuinely clean-label foods with zero added sugar, no artificial ingredients, and a promise of full transparency. Loved by over 1 million health-conscious Indians, our products are becoming the number 1 choice for conscious consumers like you. From protein bars and nut butters to whey protein, what you see is literally what you get. No jargon. No BS. Just the whole truth. Ready to snack smarter? Explore our range at thewholetruthfoods.com or your nearest store today."

Dissecting the pitch:

Hook: You shouldn’t need a science degree to read your food label.

Value Prop: We make genuinely clean-label foods with zero added sugar, no artificial ingredients, and a promise of full transparency.

Evidence: Loved by over 1 million health-conscious Indians, our products are becoming the number 1 choice for conscious consumers like you.

Differentiator: From protein bars and nut butters to whey protein, what you see is literally what you get, unlike other deceptive labels. No jargon. No BS. Just the whole truth.

CTA: Ready to snack smarter? Explore our range at thewholetruthfoods.com or your nearest store today.

User Calls Notes:

Name | Age | Gender / Marital Status | City | Occupation | Lifestyle Type | Social Media They Use | Tried TWT? | Favourite Product | Pain Points | Use Frequency | Key Insight |

|---|---|---|---|---|---|---|---|---|---|---|---|

Arya Bhanushali | 24 | Female / In a relationship | Bangalore | Freelance Social Media Associate | Wants to be fit, works from home, mostly sedentary except for 1-2 hours daily workouts. | Instagram, YouTube, LinkedIn, WhatsApp | Yes | Badaaaam Chocolate | Feels it's pricey | 2x/week initially the stopped due to price point | Prefers clean labels but hesitates due to price point. Loves taste and quality. Feels good having it because it’s clean. Believes good food is an investment. |

Punam Jain | 25 | Female / Single | Mumbai | French Credit Control | Health conscious but not very much, price sensitive, prefers cheaper alternatives, hybrid work. | Instagram, WhatsApp | Never | N/A | No cheaper options with clean labels. | N/A | Shops traditionally, doesn’t use quick delivery apps, not focused on clean labels. |

Vrushabh Karmavat | 27 | Male / In a relationship | Bangalore | Founder of an AI startup | Sedentary WFH, health conscious, reads labels, high spending appetite. | WhatsApp, LinkedIn, YouTube | Yes | Orange Dark Chocolate | Feels it's pricey | 1-2x/month | Uses fast delivery apps, trusts the brand after a proper research, recently bought isolate whey protein from TWT too because of trust in the brand. |

Minal Shah | 44 | Female / Married | Mumbai | Homemaker | Moderately active, prioritizes family health a lot, cautious buyer. Wants kids to only opt for healthy options | WhatsApp, Instagram, YouTube | No | N/A | Wants more affordable options but because of limited spending capacity and feels TWT is very expensive | N/A | Values quality and trust, buys mostly for family health, price sensitive but loyal if product delivers value. |

Akansha Goyal | 22 | Female / Single | Pune | College Student | Active lifestyle, gym enthusiast, budget conscious, influenced by peers | Instagram, YouTube, Snapchat | Yes | No Preference | Only eats if sister orders or friends order | Rare | influenced heavily by peer reviews and social media recommendations or tries just out of curiosity. Has PCOS so avoids dairy. |

General Insights after a few detailed user calls:

- The trust TWT has built is due to it's transparency and clear messaging.

- Discovery is still a huge gap. 2 users I spoke to hadn’t even heard of the brand. Why? Because they buy groceries and essentials offline and don't use apps like Zepto or Swiggy Instamart. This highlights a huge blind spot in discovery. TWT is missing out on potential users who aren’t exposed to digital-first distribution.

- The price point of TWT products is a big issue. All the users I spoke to (even the loyal ones) felt their products were pricey. However, those who are highly health-conscious are still willing to spend 20-30% extra if the product is trustworthy. Price won’t stop them, but value and transparency need to be crystal clear.

Understanding your ICP:

Ideal Customer Profile Table:

Criteria | ICP 1: Health Conscious Urban Millennials | ICP 2: Gym Goers | ICP 3: Mother of teenagers under 16 | ICP 4: Frequent Users of Quick Commerce Apps | ICP 5: Diabetic Snackers |

|---|---|---|---|---|---|

Name | Riya Mehta | Aditya Rana | Neha Verma | Tanvi Desai | Rajiv Shahani |

Age | 26 | 30 | 44 | 28 | 51 |

Gender | Female | Male | Female | Female | Male |

City | Mumbai | Bangalore | Delhi | Pune | Ahmedabad |

Marital Status | Single | Single/ In a relationship | Married | Married | Married |

Occupation | Content Marketer | Software Developer | Homemaker + Freelance Tutor | HR Manager | Business Man |

Income | 6-8 LPA | 12-16 LPA | Household income ₹20+ LPA | ₹10–12 LPA | 1-2 Cr/ Year |

Spending Capacity | Medium | High | Medium | Medium–High | High |

Lifestyle Choices | Exercises everyday, WFH, Sweet Tooth, Social Person, Loves living a good lifestyle mixed with good food and travel. | High-protein diet, strength training | Balanced home-cooked meals | Works long hours, prefers convenience | Healthy diet, daily walking |

Social Media They Use | WhatsApp, Instagram, YouTube, LinkedIn | WhatsApp, Instagram, YouTube | WhatsApp, Facebook, Instagram | Instagram, Swiggy, Zepto, YouTube | WhatsApp, Facebook, Instagram |

Who Do They Follow | Food bloggers, wellness influencers | Fitness coaches, supplement brands | Recipe pages, parenting bloggers | Beauty & Lifestyle Bloggers | Business pages, Lifestyle Influencers, Celebrities, Premium brands |

What Do They Watch/ Read/ Listen | Self Help Books, Podcasts on nutrition, YouTube on productivity | Workout videos, Joe Rogan Podcast, Puneet Rao, GetSet Fit, Beerbiceps, | YouTube recipes, Hindi TV serials | Food Reels, Quick Tasty Recipes | Aaj Tak, CNBC, Sports Channels |

Goals | Stay healthy, eat clean, avoid junk | Build muscle, lose fat, eat more protein | Ensure kids eat healthy, family wellness | Save time, healthy-ish eating without effort | Control sugar, snack safely, avoid insulin |

Pain Points | Labels are often misleading, limited options in the market | Clean snacks are expensive or not right nutrient rich. | Hard to find healthy snacks kids also like the taste of. | Healthy snacks are often hard to find quickly in local stores nearby | Very few tasty snacks with clean diabetic-safe ingredients. |

Shopping Habits | Online via Swiggy Instamart/ Zepto/ Blinkit | Direct Website, Amazon, Offline stores | Grocery stores, D-Mart, BigBasket | Swiggy Instamart, Blinkit, Zepto, Zomato, BigBasket | Supermarkets, Amazon, Premium Grocery Stores |

Ideal Customer Profile Prioritization Table

| ICP Name | Adoption Curve | Order Frequency | Appetite to Pay | TAM (Market Size) | Distribution Potential |

|---|---|---|---|---|---|

ICP 1 | Low | Medium–High | Medium | High | High |

ICP 2 | Medium | Medium | High | Medium | Medium |

ICP 3 | High | Low | Medium | Medium–High | Low |

ICP 4 | Low | High | High | High | High |

ICP 5 | Medium–High | Low–Medium | High | Low–Medium | Low |

✅ Top 2 ICPs to Prioritize:

1. ICP 4: Frequent Users of Quick Commerce Apps

Why?

- Adoption Curve is Low → They’re already familiar with and using platforms like Zepto, Instamart, etc.

- High Frequency → snacking happens multiple times a week.

- TAM is High → Young working professionals across Tier 1 & Tier 2 cities = massive user base.

- Distribution Potential is Very High → Already available on the channels they use most.

- Appetite to Pay is Medium → Acceptable, considering their impulse and convience based buying preferences.

2. ICP 1: Health Conscious Urban Millennials

Why?

- Low Adoption Curve → They're label-readers and early adopters of clean brands.

- Medium–High Frequency → Conscious daily/weekly snacking and protein intake.

- TAM is High → Urban India’s growing fitness + wellness crowd, especially post-COVID.

- Distribution Potential is High → Present on Instagram, YouTube, quick-commerce, and D2C platforms.

- Appetite to Pay is Medium → Balanced by their motivation to eat clean and well.

❌ ICPs to Deprioritize:

- ICP 3 (Mothers) have high barriers (adoption, distribution), lower frequency.

- ICP 5 (Diabetics) are very niche, smaller TAM, lower digital purchasing behaviour.

- ICP 2 (Gym Goers) has decent appetite but smaller TAM and slower adoption unless highly performance-focused products are pushed.

Product Overview

The Whole Truth Foods is a pioneering Indian brand committed to transparency and clean-label products.

Their offerings include:

- Protein Bars: Available in 12g, 15g, and 20g protein variants, these bars are crafted without added sugars or preservatives.

- Protein Powders: Offering 15g and 24g protein options, these powders are made with 100% authentic whey and no adulteration.

- Nut Spreads: Natural spreads without added sugars or preservatives.

- Muesli: A wholesome breakfast option made from natural ingredients.

- Energy Bars: Designed for sustained energy release, free from artificial additives and 100% plant based.

- Chocolates: Both milk and dark chocolates made with just three ingredients—cocoa, dates, and milk—free from refined sugars.

Core Value Proposition of The Whole Truth Foods:

For health-conscious consumers who seek transparency in their food choices, The Whole Truth Foods is a clean-label food brand that offers products made with 100% natural ingredients, free from added sugars, preservatives, and artificial flavours, ensuring trust and integrity in every bite.

Product Deep Dive:

Key Features:

- 100% natural ingredients

- No added sugar, artificial sweeteners, preservatives, or flavouring agents

- Transparent labelling with all ingredients prominently displayed on the packet

Founders Mission:

To rebuild consumer trust in packaged foods through transparency and honesty

Different Use Cases of the Products:

| Use Case | Products | Audience / Occasion |

|---|---|---|

Healthy snacking | protein bars, peanut butter | Office-goers between meetings, students prepping for exams, professionals avoiding vending machine junk |

Pre/post workout | Protein bars, peanut butter, mini bars, whey protein | Gym-goers post-workout, runners/cyclists needing sustained energy, replacing supplements |

Quick/ on the go breakfast | Muesli, peanut butter, protein bars | Busy professionals and moms, college students rushing to lectures, travellers on long journeys or whilst commuting |

Guilt-free desserts | Dark chocolate bars (date sweetened) | sweet cravings by anyone, post-meal treats, diabetics/PCOS customers |

gifting & hampers | curated boxes, variety packs | wellness gifts (colleagues, birthdays, festivals), return gifts for kids parties, corporate gifting, etc |

Dietary restrictions / lifestyles | Entire range | People with PCOS, diabetes, gluten sensitivity, Keto enthusiasts, parents seeking cleaner kids snacks, health conscious families |

Analysing Customer Feedback Across Channels:

NEGATIVE REVIEWS:

- Inconsistent Pricing Across Platforms: Customers have observed significant price differences between The Whole Truth's official website and platforms like Amazon. For instance, a 210g pack of protein powder was priced at ₹972 on the official site but available for ₹799 (₹752 with subscription) on Amazon. This has led to confusion and questions about the brand's pricing strategy.

- Perceived Marketing Gimmicks: Some consumers feel that the brand employs marketing tactics that may be misleading. For example, increasing product prices and then offering discounts that bring the price back to its original point has been criticized as a strategy that could erode customer trust.

POSITIVE REVIEWS:

TO SUMMARISE:

The Whole Truth Foods is best placed in the Indian Healthy Snacks industry, which is valued at USD 2.7–3.9 billion in 2024 and projected to nearly double by 2030–2033. The fastest-growing trends are clean label, plant-based, functional nutrition, and digital-first distribution, with TWT strongly positioned to capture urban and digitally savvy consumers in both metros and Tier 2/3 cities.

The Whole Truth Foods's Competitors

Here is the list of Top 7 competitors of The Whole Truth Foods, ranked by Tracxn score:

SWOT Analysis Of Competitors:

| Company | Why They’re Competitors | Strengths | Weaknesses |

|---|---|---|---|

OZiva | Offers nutritional foods and health supplements, overlapping with Whole Truth’s clean label health space. | - Strong brand recognition - Early market entry (2010) - Broad product range (ayurvedic + plant-based) - Backed by notable investors (F-Prime, Titan Capital) |

- Perceived as supplement - May not appeal to snack-first consumers |

Plix | Direct-to-consumer nutrition and wellness brand like Whole Truth, with a strong online presence. | - Fast digital growth - Marico backing ensures trust + strong distribution - Emphasis on clean, vegan nutrition - Multiple product categories (proteins, wellness drinks, etc.) | - Focus is more supplement-oriented than snack-based - Higher pricing in some segments |

Max Protein | Strong player in energy bars and direct competition in protein/snack bar space. | - Deep offline distribution (pan-India retail) - Strong brand recall in protein bar segment - Early mover advantage (2006) - Broad SKU range | - Brand feels more "mass-market" than clean/natural - Less digital-native - Not perceived as premium or clean-label as TWT |

Wellbeing Nutrition | Competes via plant-based superfoods and supplements targeting similar health-conscious audience. | - Premium wellness positioning - Innovation-driven (melts, slow-release capsules) | - Niche appeal in urban upper class - Less snack-focused - Lower visibility in the mid-market snack category |

Open Secret | Healthy snack brand with a strong D2C push, overlapping in both snacks and positioning for parents/kids | - Fun and family-focused branding - Gifting and snack box innovation - Good D2C engagement - Natural ingredients marketing | - Brand positioning not strictly “clean” or “truth-first” - Pricing on the higher side - Slightly confused brand identity (snack vs gifting) |

Earthful | Emerging player offering plant-based supplements that appeals to same wellness-focused, conscious demographic. | - New-age, wellness-driven image - Affordable entry-level pricing - Focus on sustainability | - Very early stage (lower trust) - Limited funding ($1M) - Small product range - Lower brand recall |

The Whole Truth Foods Key Differentiators:

Differentiator | TWT’s Position |

|---|---|

Transparency | 100% clear ingredients, no hidden additives |

Content Marketing | Deep storytelling, myth-busting, thought-leadership |

Founder-Led Brand Voice | Strong online presence of Shashank Mehta |

Product Innovation | Clean bars, date-sweetened chocolates, no stevia, no additives |

Community Engagement | High repeat customers, organic virality |

Visual Identity | Minimalist, bold, easily recognizable |

D2C-First Approach | Majority sales through own website |

Calculating TAM, SAM, SOM:

1. TAM (Total Addressable Market)

We will use the India health food & nutrition market size as a base.

India’s Health & Wellness Food Market is valued at ~$15 billion in 2025.

(Includes organic food, protein bars, cereals, functional foods, supplements, etc.)

Therefore, TAM = $15 billion (₹1.25 lakh crore)

2. SAM (Serviceable Available Market)

The Whole Truth focuses on:

- Urban upper-middle and high-income groups

- D2C + e-commerce + premium retail

- Clean-label packaged products

From the $15B market, relevant segments:

- Protein supplements & bars: ~$1.5B

- Breakfast cereals, granola, muesli: ~$1.2B

- Healthy chocolate/snacking: ~$1.3B

- Nut butters, spreads: ~$0.4B

Let’s assume they address 30-40% of the TAM via these verticals.

Therefore, SAM = $5 billion (₹41,500 crore)

3. SOM (Serviceable Obtainable Market)

Estimate based on:

- Competition: RiteBite, YogaBar, Oziva, mCaffeine, etc.

- Distribution: Online D2C + Amazon + limited modern retail

- Revenue estimate for The Whole Truth (2023-24): ~$10–15 million

- Growth projection

- Brand positioning: Niche clean-label segment

Let’s assume a realistic capture of 0.25% to 0.5% of SAM over 2–3 years.

Therefore, SOM = $12.5M – $25M (₹100–200 crore)

Metric | Description | Estimate |

|---|---|---|

TAM | Entire Indian health/wellness food market | ₹1.25 lakh crore |

SAM | Segments relevant to The Whole Truth | ₹41,500 crore |

SOM | Realistic short-term market capture | ₹100–200 crore |

We have concluded that The Whole Truth Foods is in its Early Scaling stage based on the following factors:

✅ It's steadily expanding SKUs and categories

✅ High spend on paid acquisition and branding

✅ It is focusing on penetrating wider demographics and channels

✅ It's actively experimenting with partnerships, influencers, and physical retail

Video: https://growthx.cc/only-truth

Channel Name | Cost | Flexibility | Effort | Speed | Scale |

|---|---|---|---|---|---|

Organic | Low | High | High | Medium | High |

Paid Ads | High | High | Medium | High | High |

Referral Program | Low | Medium | Medium | Low-Medium | Medium |

Product Integration | Medium | Low | High | Medium | High |

Content Loops | Medium | High | Medium | Medium | High |

Top 3 Prioritized Channel:

Channel | Reasoning |

|---|---|

Meta + Google Paid Ads | Fastest way to reach high-intent users, test creatives, and drive D2C sales. Meta is great for storytelling (top of funnel), and Google for bottom-of-funnel (search intent like “best protein bars India”). You can optimize for ROAS quickly. |

Organic Social Media (SEO) | This is where The Whole Truth can shine a lot with strong visual branding + storytelling. Reels can drive organic discovery and brand trust. UGC is already working for TWT so we can double down to build community + content loop. |

Content Loop (User Generated Content) | The compounding channel. |

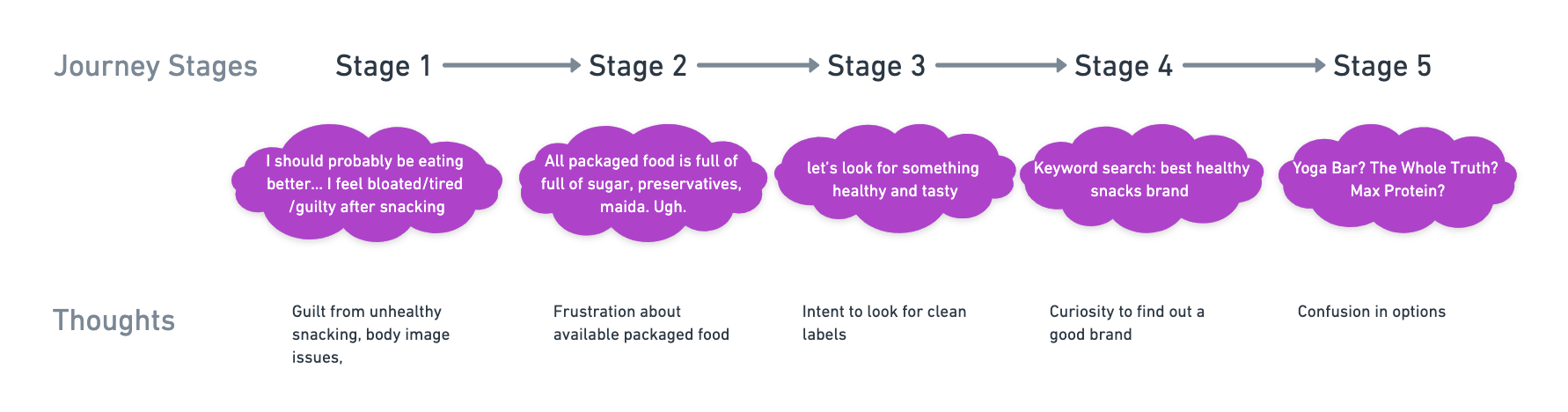

Thoughts ICPs go through:

Overview of SEO Performance:

- Monthly Visits: Approximately 955,400, with a 2.05% decrease from the previous month.

- Bounce Rate: 35.55%, indicating good user engagement.

- Pages per Visit: 4.37

- Average Visit Duration: 3 minutes 52 seconds

- Traffic Sources:

- Organic Search: 51.82%

- Direct: 34.83%

- Social Media: Primarily from YouTube, followed by Facebook and X (Twitter).

Top Ranking Keywords:

All of they're top ranked keywords are branded keywords, indicating strong brand recognition.

✅ What's working well:

- High search volumes for branded terms suggest effective brand awareness campaigns.

- Low bounce rate and high pages per visit indicate that users find the content relevant and engaging.

- Over half of the traffic comes from organic search, showcasing successful SEO efforts.

- Significant traffic from YouTube suggests that video content is resonating with the audience.

❌ What can be improved:

- The focus on branded keywords may limit the discovery by new customers searching for generic terms like "healthy snacks" or "protein bars India." So, we need to put efforts at ranking non-branded keywords.

- Limited SEO optimized content around new categories (e.g nut butters, muesli, chocolates).

- Missing out on “best of” and comparison keyword traffic (e.g “best protein bars in India,” “top clean label snacks”, etc)

Tool used to conduct research: https://pro.similarweb.com/#/activation/home

Current Content Loops at The Whole Truth Foods:

- Shashank Mehta, the founder, leverages his personal journey and experiences to build trust and authenticity via personal branding.

- Leveraging educational content via "TRUTH BE TOLD" - A weekly newsletter and blog series aiming to debunk food myths and provide honest information.

- Social Media Content that is a mix of UGC, Reviews, humour, etc to engage audiences on platforms like Instagram.

Analysis of Effectiveness:

Content Loop | Strengths | Areas for Improvement |

|---|---|---|

Founder's Voice | Authenticity, trust-building | Scalability beyond founder's personal brand |

Educational Content | Establishes authority, informative | Broader distribution needed |

Social Media Engagement | High engagement, relatability | Consistency in posting, platform diversification |

Understanding TWT Foods Audience:

Based on previous ICP work, TWT’s core audiences include:

- Gym goers and fitness enthusiasts

- Urban millennials (young professionals in metros)

- Young bachelors and couples (25-40, health-conscious, busy lifestyles)

- Parents seeking healthy options for teens

- People with dietary restrictions (keto, diabetics etc.)

Where do they spend time?

- Fitness communities: Cult.Fit, gym WhatsApp groups, Strava, running clubs, Reddit fitness threads

- YouTube and podcasts: For long-form, credible content on health and nutrition

- LinkedIn: For urban professionals and wellness content

- WhatsApp and Telegram: For sharing quick tips, recipes, and product recommendations

- Niche Facebook groups and forums: Focused on diets, parenting, and wellness

- Email/newsletters: For deeper, trusted information (TWT’s “Truth Be Told” already has traction here)

- Product review platforms: Amazon, health food review sites,etc

What Are They Talking About?

- Busting food myths and decoding labels “Is this really healthy?” “What’s in my protein bar?”

- Fitness journeys “How do I get enough protein?” “What’s a sustainable diet?”

- Quick and healthy recipes.

- Honest product reviews and recommendations like “Which brands can I trust?”

- Mental health and body positivity.

- Parenting and healthy snacking options for kids.

- Trends: New diets, intermittent fasting, plant-based eating, cutting sugar, etc

Suggested Content Loops:

**ealityCheckWithTWT

The Concept

Every time someone goes to a supermarket or grocery store, they pick up any “healthy” packaged food, snap a photo of its ingredient label, and post it to their Instagram story (or Twitter, LinkedIn, wherever) with the hashtag #RealityCheckWithTWT. They tag TWT. In the caption, they either highlight something weird/unpronounceable in the ingredients or just ask, “Is this really healthy?” or “What’s this ingredient?”

TWT then re-shares the best/funniest/most shocking ones on their own social media, newsletters, and even in a dedicated “Label Hall of Shame” section on their website. This turns into a viral, ongoing, community-powered “reality check” movement around food transparency.

Why This Loop Will Work

1. It’s Relatable

This loop taps directly into that universal moment of “Wait, what even IS this?”. It’s a shared frustration, so people will want to join in and see what others are finding.

2. It’s Shareable

The hashtag gives it a sense of community and momentum; people love being part of a “movement.”. Seeing friends do it will nudge others to participate.

3. It’s Educational, But Fun

Instead of TWT preaching about food transparency, the audience discovers the truth themselves. This is way more powerful and sticky. TWT can add witty, meme-like commentary when they reshare (“Is this a snack or a chemistry experiment?”), making it entertaining.

4. It’s a Content Goldmine for TWT

User-generated content (UGC) comes pouring in, giving TWT endless material for their own channels. The best/funniest/most outrageous labels can be featured in a weekly “Label Hall of Shame” email or post, keeping the loop alive. TWT can even do expert breakdowns of the most confusing labels, adding value and authority.

5. It Drives Brand Affinity and Trust

TWT positions itself as the “good guy” in a world of shady food marketing. By amplifying consumer voices, TWT shows it’s on the side of the customer, not the industry. Every time someone tags TWT, their friends see the brand in a positive, empowering context.

6. It’s a Real “Loop”

Each new post inspires more people to check labels, post, and tag TWT.

- The more TWT shares, the more people want to get featured.

- Over time, this becomes a habit where people can’t resist doing a #RealityCheckWithTWT whenever they shop.

How to Kickstart It

- Launch with a witty video or meme from TWT’s founder, showing him in a supermarket, confused by a label, and starting the hashtag.

- Offer a weekly prize for the “craziest label” or “best reality check,” like a free TWT snack box.

- Feature top posts in the newsletter, on Instagram highlights, and on a dedicated web page.

Hook | Creators | Distributors |

|---|---|---|

Snap a food label, post with #RealityCheckWithTWT, tag TWT, and call out weird ingredients. | Shoppers, fitness enthusiasts, health conscious shoppers, TWT fans, nutritionists | Instagram, WhatsApp, Twitter, TWT’s own social handles, TWT newsletter, website, linkedin, reddit, quora |

CAC : LTV Ratio

- Customer Acquisition Cost (CAC): ₹200–₹350 per customer (depending on channel & conversion rates).

- Customer Lifetime Value (LTV) (estimated):

- Avg. Order Value: ₹500

- Repeat Purchase Frequency: 5x/year

- Retention: 2 years (based on brand loyalty)

- LTV = ₹500 × 5 × 2 = ₹5,000

Ratio = ₹5,000 / ₹300 = 16.6:1

✅ Healthy CAC:LTV Ratio → Proceed with Paid Ads

Primary ICP:

- Urban Indian millennials (25–35 years old)

- Income: ₹10L+ per annum

- Health-conscious professionals

- Regular online grocery shoppers

- Interested in fitness, wellness, clean eating

Now to attract this ICP, Meta platforms i.e. (Facebook and Instagram) are ideal for visual storytelling, influencer collaborations in the organic segment. In paid, TWT can tap upon Google Search and Display ads to capture high-intent buyers searching for terms like “healthy snacks” or “best protein bars.”

Marketing Pitch:

“India’s only 100% clean-label food brand. No secrets, no junk, just real ingredients you can trust. Snack smarter with The Whole Truth.”

THE END!

Thank You For Reading My Project 💙

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.